What about a Texas Father’s Summer Visitation? The Standard Child Possession Order – Texas Family Code

When parents are battling over divorce issues and child custody, they often times do not understand that the Texas Family Code has expanded the standard child possession order to make joint managing conservators with more equal rights and duties and possession of the child. It is important to keep in mind that, under certain circumstances, and depending on the age of a child, a judge may alter the standard possession order in any way that serves the best interest of the child.

The following is an example of a standard possession order for a parent who lives within 100 miles of their child under the Texas Family Code.

IT IS ORDERED that the conservators shall have possession of the child at times mutually agreed to in advance by the parties, and, in the absence of mutual agreement, it is ORDERED that the conservators shall have possession of the child under the specified terms set out in this Standard Possession Order.

PARENTS WHO RESIDE UNDER 100 MILES APART:

Except as otherwise explicitly provided in this Standard Possession Order, when Possessory Conservator resides 100 miles or less from the primary residence of the child, Possessory Conservator shall have the right to possession of the child as follows:

3. Weekends—

Weekends that do not occur during the regular school term, beginning at 6:00 p.m. on the first, third, and fifth Friday of each month and ending at 6:00 p.m. on the following Sunday.

2. Extended Summer Possession by Possessory Conservator—

With Written Notice by April 1—If Possessory Conservator gives Managing Conservator written notice by April 1 of a year specifying an extended period or periods of summer possession for that year, Possessory Conservator shall have possession of the child for thirty days beginning no earlier than the day after the child’s school is dismissed for the summer vacation and ending no later than seven days before school resumes at the end of the summer vacation in that year, to be exercised in no more than two separate periods of at least seven consecutive days each, as specified in the written notice, provided that the period or periods of extended summer possession do not interfere with Father’s Day Weekend. These periods of possession shall begin and end at 6:00 p.m.

Without Written Notice by April 1—If Possessory Conservator does not give Managing Conservator written notice by April 1 of a year specifying an extended period or periods of summer possession for that year, Possessory Conservator shall have possession of the child for thirty consecutive days in that year beginning at 6:00 p.m. on July 1 and ending at 6:00 p.m. on July 31.

Notwithstanding the Thursday periods of possession during the regular school term and the weekend periods of possession ORDERED for Possessory Conservator, it is explicitly ORDERED that Managing Conservator shall have a superior right of possession of the child as follows:

2. Summer Weekend Possession by Managing Conservator—If Managing Conservator gives Possessory Conservator written notice by April 15 of a year, Managing Conservator shall have possession of the child on any one weekend beginning at 6:00 p.m. on Friday and ending at 6:00 p.m. on the following Sunday during any one period of the extended summer possession by Possessory Conservator in that year, provided that Managing Conservator picks up the child from Possessory Conservator and returns the child to that same place and that the weekend so designated does not interfere with Father’s Day Weekend.

3. Extended Summer Possession by Managing Conservator—If Managing Conservator gives Possessory Conservator written notice by April 15 of a year or gives Possessory Conservator fourteen days’ written notice on or after April 16 of a year, Managing Conservator may designate one weekend beginning no earlier than the day after the child’s school is dismissed for the summer vacation and ending no later than seven days before school resumes at the end of the summer vacation, during which an otherwise scheduled weekend period of possession by Possessory Conservator shall not take place in that year, provided that the weekend so designated does not interfere with Possessory Conservator’s period or periods of extended summer possession or with Father’s Day Weekend.

PARENTS WHO RESIDE OVER 100 MILES APART:

If the possessory conservator resides more than 100 miles from the residence of the child, the possessory conservator shall have the right to possession of the child as follows:

1. Summer Possession:

(A) Gives the managing conservator written notice by April 1 of each year specifying an extended period or periods of summer possession, the possessory conservator shall have possession of the child for 42 days beginning not earlier than the day after the child’s school is dismissed for the summer vacation and ending not later than seven days before school resumes at the end of the summer vacation, to be exercised in not more than two separate periods of at least seven consecutive days each with each period of possession beginning and ending at 6 p.m. on each applicable day; or

(B) Does not give the managing conservator written notice by April 1 of each year specifying an extended period or periods of summer possession, the possessory conservator shall have possession of the child for 42 consecutive days beginning at 6 p.m. on June 15 and ending at 6 p.m. on July 27;

2. If the managing conservator gives the possessory conservator written notice by April 15 of each year the managing conservator shall have possession of the child on one weekend beginning Friday at 6 p.m. and ending at 6 p.m. on the following Sunday during one period of possession by the possessory conservator under Subdivision (3), provided that if a period of possession by the possessory conservator exceeds 30 days, the managing conservatory may have possession of the child under the terms of this subdivision on two nonconsecutive weekends during that time period, and further provided that the managing conservator picks up the child from the possessory conservator and returns the child to that same place; and

3. If the managing conservatory give the possessory conservator written notice by April 15 of each year, the managing conservator may designate 21 days beginning not earlier than the day after the child’s school is dismissed for the summer vacation and ending not later than seven days before school resumes at the end of the summer vacation, to be exercised in not more than two separate periods of at least seven consecutive days each with each period of possession beginning and ending at 6 p.m. on each applicable day, during which the possessory conservator may not have possession of the child, provided that the period or periods so designated do not interfere with the possessory conservator’s period or periods of extended summer possession or with Father’s Day if the possessory conservator is the father of the child.

Holidays Unaffected by Distance

Notwithstanding the weekend and Thursday periods of possession of Possessory Conservator, Managing Conservator and Possessory Conservator shall have the right to possession of the child as follows:

Father’s Day Weekend—Father shall have the right to possession of the child each year, beginning at 6:00 p.m. on the Friday preceding Father’s Day and ending at 6:00 p.m. on Father’s Day, provided that if Father is not otherwise entitled under this Standard Possession Order to present possession of the child, he shall pick up the child from the other conservator’s residence and return the child to that same place.

General Terms and Conditions

Except as otherwise explicitly provided in this Standard Possession Order, the terms and conditions of possession of the child that apply regardless of the distance between the residence of a parent and the child are as follows:

1. Surrender of Child by Managing Conservator—Managing Conservator is ORDERED to surrender the child to Possessory Conservator at the beginning of each period of Possessory Conservator’s possession at the residence of Managing Conservator.

If a period of possession by Possessory Conservator begins at the time the child’s school is regularly dismissed, Managing Conservator is ORDERED to surrender the child to Possessory Conservator at the beginning of each such period of possession at the school in which the child is enrolled. If the child is not in school, Possessory Conservator shall pick up the child at the residence of Managing Conservator at 6:00 p.m., and Managing Conservator is ORDERED to surrender the child to Possessory Conservator at the residence of Managing Conservator at 6:00 p.m. under these circumstances.

2. Surrender of Child by Possessory Conservator—Possessory Conservator is ORDERED to surrender the child to Managing Conservator at the residence of Managing Conservator at the end of each period of possession.

3. Return of Child by Possessory Conservator—Possessory Conservator is ORDERED to return the child to the residence of Managing Conservator at the end of each period of possession. However, it is ORDERED that, if Managing Conservator and Possessory Conservator live in the same county at the time of rendition of this order, Possessory Conservator’s county of residence remains the same after rendition of this order, and Managing Conservator’s county of residence changes, effective on the date of the change of residence by Managing Conservator, Possessory Conservator shall surrender the child to Managing Conservator at the residence of Possessory Conservator at the end of each period of possession.

If a period of possession by Possessory Conservator ends at the time the child’s school resumes, Possessory Conservator is ORDERED to surrender the child to Managing Conservator at the end of each such period of possession at the school in which the child is enrolled or, if the child is not in school, at the residence of Managing Conservator at [address].

4. Surrender of Child by Possessory Conservator—Possessory Conservator is ORDERED to surrender the child to Managing Conservator, if the child is in Possessory Conservator’s possession or subject to Possessory Conservator’s control, at the beginning of each period of Managing Conservator’s exclusive periods of possession, at the place designated in this Standard Possession Order.

5. Return of Child by Managing Conservator—Managing Conservator is ORDERED to return the child to Possessory Conservator, if Possessory Conservator is entitled to possession of the child, at the end of each of Managing Conservator’s exclusive periods of possession, at the place designated in this Standard Possession Order.

6. Personal Effects—each conservator is ORDERED to return with the child the personal effects that the child brought at the beginning of the period of possession.

7. Designation of Competent Adult—each conservator may designate any competent adult to pick up and return the child, as applicable. IT IS ORDERED that a conservator or a designated competent adult be present when the child is picked up or returned.

8. Inability to Exercise Possession—each conservator is ORDERED to give notice to the person in possession of the child on each occasion that the conservator will be unable to exercise that conservator’s right of possession for any specified period.

9. Written Notice—written notice shall be deemed to have been timely made if received or postmarked before or at the time that notice is due.

10. Notice to School and Managing Conservator—If Possessory Conservator’s time of possession of the child ends at the time school resumes and for any reason the child is not or will not be returned to school, Possessory Conservator shall immediately notify the school and Managing Conservator that the child will not be or has not been returned to school.

Again, a Judge may under varied circumstances change any provision of a Standard Possession Order.

Preventing Out of State Relocation of Children by Custodial Parent

Mom and Dad are divorcing or have been divorced and are now sharing joint custody of their children in the same city in Texas. One parent receives a letter from the other parent’s attorney requesting that this parent be allowed to relocate the children to another state so he/she may take a better job position with another company! This is a dilemma no parent ever wants to experience! Child Custody cases involving interstate relocation jurisdiction issues cause much heartache and are costly legal battles.

What can a Parent do to protect themselves from children being relocated away from the non-moving parent to another state without her/his consent? How may this affect the parent’s relationship with the children?

The Texas Family Code 153.002 Best Interest of Child states “The best interest of the child shall always be the primary consideration of the court in determining the primary consideration of the court in determining the issues of conservatorship and possession of and access to the child.”

The Texas Family code does not elaborate on the specific requirement for modification in the residency-restriction context, and there are no specific statutes governing residency restrictions or their removal for purposes of relocation. Texas Courts have no statutory standards to apply to this context.

The Texas Legislature has provided Texas Family Code 153.001, a basic framework on their public policy for all suits affecting the parent-child relationship:

-

The public policy of this state is to:

-

Assure the children will have frequent and continuing contact with parents who have shown the ability to act in the best interest of the child;

-

Provide a safe, stable, and nonviolent environment for the child;

-

Encourage parents to share in the rights and duties of raising their child after the parents have separated or dissolved their marriage.

How does The State of Texas treat an initial Child Custody determination?

Texas Family Code 152.201 of the UCCJEA states, among other things, that a court may rule on custody issues if the Child:

*Has continually lived in that state for 6 months or longer and Texas was the home state of the child within six months before the commencement of the legal proceeding.

*Was living in the state before being wrongfully abducted elsewhere by a parent seeking custody in another state. One parent continues to live in Texas.

*Has an established relationship with people (family, relatives or teachers), ties, and attachments in the state

*Has been abandoned in an emergency: or is safe in the current state, but could be in danger of neglect or abuse in the home state

Relocation is a child custody situation which will turn on the individual facts of the specific case, so that each case is tried on its own merits.

Most child custody relocation cases tried in Texas follow a predictable course:

-

Allowing or not allowing the move.

-

Order of psychological evaluations or social studies of family members

-

Modification of custody and adjusting of child’s time spent with parents

-

Adjusting child support

-

Order of mediation to settle dispute

-

Allocating transportation costs

-

Order opposing parties to provide all information on child’s addresses and telephone #

Help to Prevent Your Child’s Relocation in a Texas Court by Preparing Your Case!

-

Does the intended relocation interfere with the visitation rights of the non- moving parent?

-

The effect on visitation and communication with the non-moving parent to maintain a full and continuous relationship with the child

-

How will this move affect extended family relationships living in the child’s current location?

-

Are there bad faith motives evident in the relocating parent?

-

Can the non-moving parent relocate to be close to the child? If not, what type of separation hardship would the child have?

-

The relocating parent’s desire to accommodate a new job, spouse, or other criteria above the parent-child relationship. A Parent’s personal desire for move rather than need to move?

-

Is there a significant degree of economic, emotional or education enhancement for the relocating parent and child in this move?

-

Any violation of an order or prior notice of the intended move or a temporary restraining order

-

Are Special Needs/ Talents accommodated for the child in this move?

-

Fear of child and high cost of travel expenses for non-moving parent or child to visit each other to be able to continue parent- child relationship.

-

What other Paramount Concerns would affect the child concerning the relocation from the non-moving parent?

At the Nacol Law Firm PC, we represent many parents trying to prevent their child from relocating to another city or state and having to experience “A Long Distance Parental Relationship” brought on by a better job or new life experience of the relocating parent! We work at persuading courts to apply the specific, narrow exceptions to these general rules in order to have child custody cases heard in the most convenient forum in which the most qualifying, honest evidence is available; cases where the child’s home state or other basic questions are clarified, and cases where a parent has the right in close proximity with their child regardless of other less important factors.

Rights and Duties of a Parent – Joint Managing Conservator in Texas

Rights and Duties of a Parent – Joint Managing Conservator in Texas.

Waiver To the Guidelines is a Matter of Court Discretion

As a joint managing conservator of a child in a divorce proceeding in Texas, unless special circumstances arise justifying a variance from the Guidelines, the Court will normally order guideline code rights and duties and a parent will be awarded the following:

1.the right to receive information from any other conservator of the child concerning the health, education, and welfare of the child.

2.the right to confer with the other parent to the extent possible before making a decision concerning the health, education, and welfare of the child.

3.the right of access to medical, dental, psychological, and educational records of the child.

4.the right to consult with a physician, dentist, or psychologist of the child.

5.the right to consult with school officials concerning the child’s welfare and educational status, including school activities.

6.the right to attend school activities.

7.the right to be designated on the child’s records as a person to be notified in case of an emergency.

8.the right to consent to medical, dental, and surgical treatment during an emergency involving an immediate danger to the health and safety of the child.

9.the right to manage the estate of the child to the extent the estate has been created by the parent/conservator or the parent/conservator’s family.

10.the duty to inform the other conservator of the child in a timely manner of significant information concerning the health, education, and welfare of the child; and

11.the duty to inform the other conservator of the child if the conservator resides with for at least thirty days, marries, or intends to marry a person who the conservator knows is registered as a sex offender under chapter 62 of the Code of Criminal Procedure or is currently charged with an offense for which on conviction the person would be required to register under that chapter. IT IS ORDERED that this information shall be tendered in the form of a notice made as soon as practicable, but not later than the fortieth day after the date the conservator of the child begins to reside with the person or on the tenth day after the date the marriage occurs, as appropriate. IT IS ORDERED that the notice must include a description of the offense that is the basis of the person’s requirement to register as a sex offender or of the offense with which the person is charged. WARNING: A CONSERVATOR COMMITS AN OFFENSE PUNISHABLE AS A CLASS C MISDEMEANOR IF THE CONSERVATOR FAILS TO PROVIDE THIS NOTICE.

12.the duty of care, control, protection, and reasonable discipline of the child.

13.the duty to support the child, including providing the child with clothing, food, shelter, and medical and dental care not involving an invasive procedure.

14.the right to consent for the child to medical and dental care not involving an invasive procedure.

15.the right to direct the moral and religious training of the child.

16.Only one parent shall have the exclusive right to designate the primary residence of child in a specific geographical area, which is commonly the county in which the child currently resides and the contiguous counties thereto.

17.the right to consent to medical, dental, and surgical treatment involving invasive procedures may be subject to agreement, an independent right or an exclusive right;

18.the right to consent to psychiatric and psychological treatment of the child may be subject to agreement, an independent right or an exclusive right;

19.Only one parent shall have the exclusive right to receive and give receipt for periodic payments for the support of the child and to hold or disburse these funds for the benefit of the child;

20.the right to represent the child in legal action and to make other decisions of substantial legal significance concerning the child may be subject to agreement, an independent right or an exclusive right;

21.the right to consent to marriage and to enlistment in the armed forces of the United States may be subject to agreement, an independent right or an exclusive right;

22.the right to make decisions concerning the child’s education may be subject to agreement, an independent right a joint right or an exclusive right;

23.except as provided by section 264.0111 of the Texas Family Code, the right to the services and earnings of the child may be subject to agreement, an independent right or an exclusive right;

24.except when a guardian of the child’s estate or a guardian or attorney ad litem has been appointed for the child, the right to act as an agent of the child in relation to the child’s estate if the child’s action is required by a state, the United States, or a foreign government may be subject to agreement, an independent right or an exclusive right; and

25.the right to manage the estate of the child to the extent the estate has been created by community property or the joint property of the parent/conservator may be subject to agreement, an independent right or an exclusive right.

In accordance with section 153.001 of the Texas Family Code, it is the public policy of Texas to assure that children will have frequent and continuing contact with parents who have shown the ability to act in the best interest of the child, to provide a safe, stable, and nonviolent environment for the child, and to encourage parents to share in the rights and duties of raising their child after the parents have separated or dissolved their marriage. The Court will therefore normally establish the primary residence of the child in the county where the child currently resides and/or a contiguous county thereto, and the parties shall not remove the child from such county for the purpose of changing the primary residence of child until there is a modification to the existing order of the court of continuing jurisdiction or a written agreement signed by the parties and filed with the court.

The geographical restriction on the residence of the child may be lifted or modified if, at the time the primary parent with the right to establish residence wishes to remove the child from the county for the purpose of changing the primary residence of the child, the other parent does not reside in that county or a contiguous county thereto.

Time constraints, employment issues of the primary Joint Managing Conservator, and other material factors may come into play when a Joint Managing Conservator requests waiver of the geographical restrictions. It customarily is a very difficult, but not always insurmountable, burden to achieve a geographical restriction waiver. The success, consistency and regularity of the non-primary conservator’s possession and access to the child is a factor the court will view in making a ruling. Frequently, an agreement to adjust the amount of support and/or transportation costs comes into play in resolving such disputes.

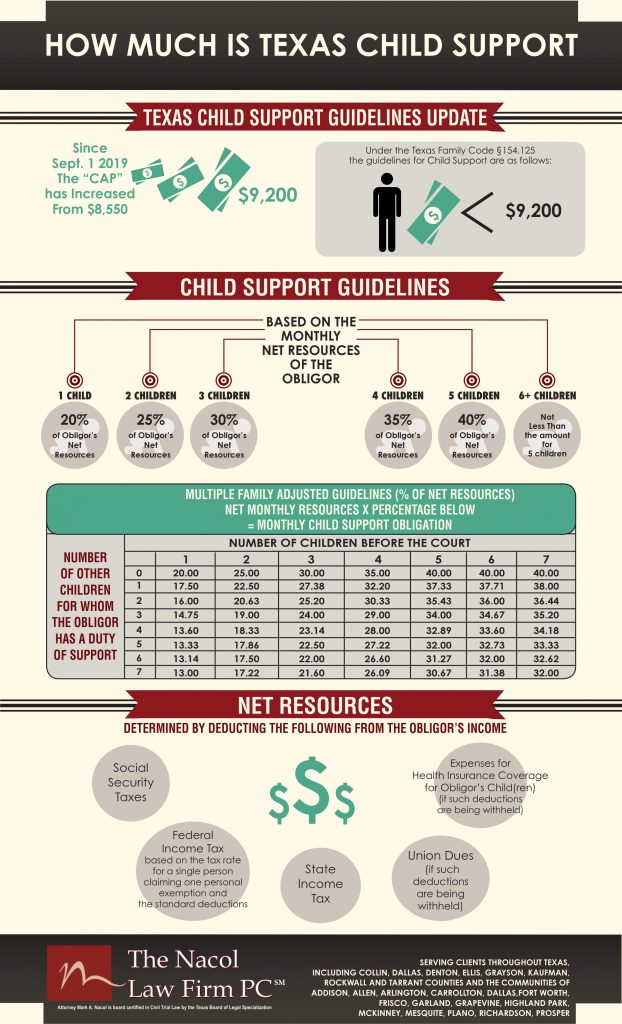

How Much is Texas Child Support? Texas Child Support Guidelines

Effective September 1, 2019 The Texas Child Support Division of the Attorney General increased the Maximum child Support under the Texas Child Support Guidelines from $8,550 to the “new cap”of net monthly resources to $9200 annually. This change in the law will increase the amount of maximum child support from of $1,710.00 to $1,840.00 monthly (20% of $9200. For one child)

Texas Family Code §154.125(a)(1) requires that every six years the presumptive amount of net resources to which the child support guidelines apply shall be reviewed and adjusted for inflation by the Texas Office of the Texas Attorney General (OAG). That section sets out the formula for doing so based on the consumer price index. The last adjustment was done in 2013 when the current amount of $8550 per month was established.

How does the “cap” work and what could this mean for you? If your net monthly resources are less than $8,550, the child support obligation will not change on Sept. 1. You are under the “current cap” and lower than the “new cap”. All stays the same.

If you are currently going through litigation and your net monthly resources exceeds $8,550 and the Court orders child support prior to September 1, 2019, Texas Child Support Guidelines will mandate that the Court apply the appropriate child support percentage to the first $8,550 in net monthly resources based on the number of children. But, if the Court orders child support after September 1, 2019, it will apply the new appropriate child support percentage to the first $9,200 in net monthly resources.

Child support under the guidelines is determined by applying the applicable percentage, beginning at 20% for one child and increasing incrementally for each additional child, to the net resources amount. If a child support obligor has monthly net resources over $9200, a party seeking above the guideline’s child support has the burden of proving to the court that additional support should be ordered according to factors set out in Texas Family Code §154.126.

Important to Know: The new “cap” increase of September 1, 2019 will not automatically increase the obligor’s existing child support obligation. Any change in child support standing before September 1, 2019, can only occur through the court with a modification order to increase the child support to the new “Cap” amount of $9200. After September 1, 2019, any new suit for child support will be subject to the new “cap”.

Please review the Texas Office of the Texas Attorney General (OAG) website for a child support calculator for the new breakdown: https://csapps.oag.texas.gov/monthly-child-support-calculator

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite #1190

Dallas, Texas 75231

Nacollawfirm.com

Unique Possession Orders that Work with a Fathers Profession

Many professions create impositions on conservators making a standard possession order inapplicable and unworkable. The Court may deviate from a standard possession order if the order is inappropriate or unworkable in reference to the schedules of both the conservators and the child. Unique professions and irregular school schedules for children allow the Court to have flexibility to deviate from a standard possession order that is in the Best Interest of the Child. There are multiple ways in which the Court may depart from a standard possession order to fulfill the needs of all parties involved with the custody of the child.

First, the Family Code § 153.254 states that the Court will be allowed deference to modify the standard possession order if work schedules of either conservators or the school schedule of the child is irregular. The Court must attempt to narrowly tailor the modifications to keep the new possession order as similar to the standard possession order as possible. This instance most commonly occurs when the Managing Conservator and the Possessory Conservator cannot reach an agreement and one of the two Conservators has a unique profession such as a firefighter, police officer, or airline pilot. The working hours of these jobs allow the Court to modify the standard possession order even if both of the parties do not comply with the changes. The modifications must be made only if it is in the Best Interest of the Child.

Secondly, the standard possession order may always be modified if it is by the mutual agreement of both the Managing Conservator and Possessory Conservator. Family Code § 153.007 is the Agreed Parenting Plan Statute and allows for both parties to agree on a standard possession order for the child. This statute was passed to promote amicability in settlement for child custody issues and to give flexibility to the parents if they are willing to agree on custody terms. The Agreed Parenting Plan must be in the Best Interest of the Child for the Court to approve. If the Court grants the Agreed Parenting Plan then the Managing or Possessory Conservator will have a remedy as a matter of law for any violation of the agreement committed by either party.

Finally, both Conservators may enter into a Mediated Settlement Agreement under Family Code § 153.0071. A Mediated Settlement Agreement is the only time in which the Court will NOT look at the Best Interest of the Child when granting the custody agreement.

The Mediated Settlement Agreement § 153.0071 must be:

- In bold, underlined, and capital letters that the agreement is NOT REVOCABLE

- Signed by Both Parties to the agreement

- Signed by the lawyers (if represented) of each party

The Mediated Settlement Agreement is binding and not revocable so if the Conservators wish to go this route they must understand that what is in the agreement will be held as binding. This method can be used to modify or change a standard possession order and the Court will not look at the Best Interest of the Child regarding the agreement, unless there exists a credible threat of domestic violence.

These are the methods in which a unique possession order may be obtained to accommodate irregular schedules or working hours of both the conservators. Any possession order must be correctly drafted and all future contingencies must be accounted for. An experienced lawyer must be contacted to safeguard an individual’s custody rights of their children and to make sure that a fair custody arrangement is obtained.