How Much is Texas Child Support? Texas Child Support Guidelines

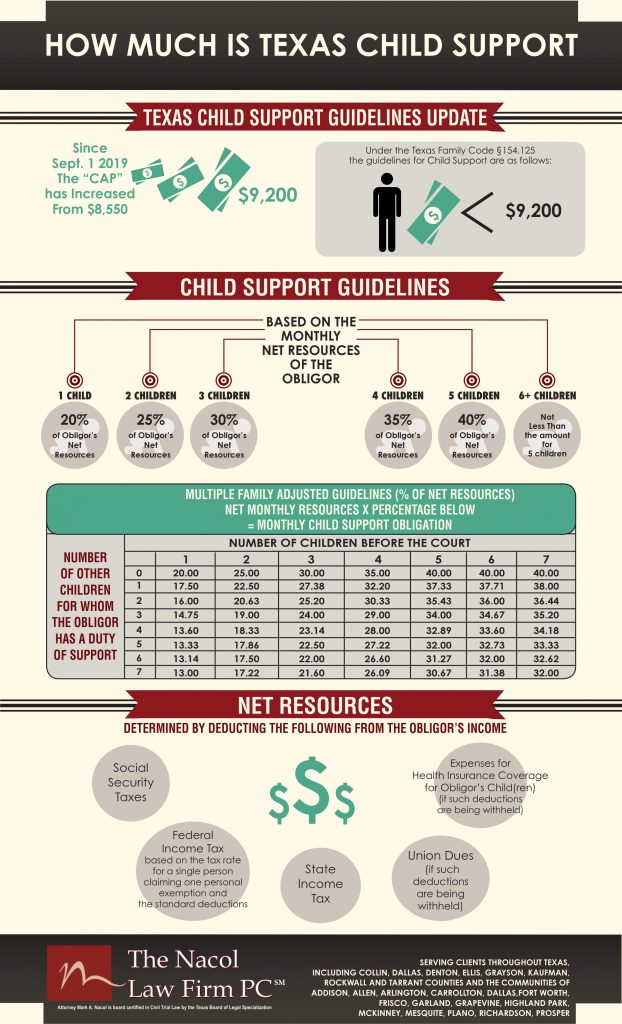

Effective September 1, 2019 The Texas Child Support Division of the Attorney General increased the Maximum child Support under the Texas Child Support Guidelines from $8,550 to the “new cap”of net monthly resources to $9200 annually. This change in the law will increase the amount of maximum child support from of $1,710.00 to $1,840.00 monthly (20% of $9200. For one child)

Texas Family Code §154.125(a)(1) requires that every six years the presumptive amount of net resources to which the child support guidelines apply shall be reviewed and adjusted for inflation by the Texas Office of the Texas Attorney General (OAG). That section sets out the formula for doing so based on the consumer price index. The last adjustment was done in 2013 when the current amount of $8550 per month was established.

How does the “cap” work and what could this mean for you? If your net monthly resources are less than $8,550, the child support obligation will not change on Sept. 1. You are under the “current cap” and lower than the “new cap”. All stays the same.

If you are currently going through litigation and your net monthly resources exceeds $8,550 and the Court orders child support prior to September 1, 2019, Texas Child Support Guidelines will mandate that the Court apply the appropriate child support percentage to the first $8,550 in net monthly resources based on the number of children. But, if the Court orders child support after September 1, 2019, it will apply the new appropriate child support percentage to the first $9,200 in net monthly resources.

Child support under the guidelines is determined by applying the applicable percentage, beginning at 20% for one child and increasing incrementally for each additional child, to the net resources amount. If a child support obligor has monthly net resources over $9200, a party seeking above the guideline’s child support has the burden of proving to the court that additional support should be ordered according to factors set out in Texas Family Code §154.126.

Important to Know: The new “cap” increase of September 1, 2019 will not automatically increase the obligor’s existing child support obligation. Any change in child support standing before September 1, 2019, can only occur through the court with a modification order to increase the child support to the new “Cap” amount of $9200. After September 1, 2019, any new suit for child support will be subject to the new “cap”.

Please review the Texas Office of the Texas Attorney General (OAG) website for a child support calculator for the new breakdown: https://csapps.oag.texas.gov/monthly-child-support-calculator

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite #1190

Dallas, Texas 75231

Nacollawfirm.com

Child Support: Gender Neutral Pro Rata Child Support Obligations

One of the most frequent inquiries we receive at The Nacol Law Firm is whether child support obligations are equally applied between Mothers and Fathers. When a parent is considering a divorce or a union break up with the child’s other parent, who pays for child support and medical/dental insurance for the child, for how long and according to what guidelines?

The State of Texas (Texas Family Code Ch 154) Sec. 154.001. SUPPORT OF CHILD. (a) The court may order “Either” or “Both” parents to support a child in the manner specified by the order: (1) until the child is 18 years of age or until graduation from high school, whichever occurs later; (2) until the child is emancipated through marriage, through removal of the disabilities of minority by court order, or by other operation of law; (3) until the death of the child; or (4) if the child is disabled as defined in this chapter, for an indefinite period.

The State of Texas child support laws dictate that children are entitled to financial support from both parents. Texas establishes child support guidelines to determine how much an average child will need. The guidelines provide for a basic amount of support to the parent who receives it based on the other parent’s income and number of children to be supported. However, there may be special circumstances that justify the court’s deviation from the standard amount of child support. Extraordinary expenses can be taken into consideration, including medical expenses or high childcare costs and other specific exceptions.

The State of Texas also supports that a Father and Mother should have the relatively equal rights to the child and should share in the child’s care and support. What does that mean? If Mom or Dad each have standard access and possession 50% of the time, then the Father and Mother should pay guideline support for the care of the child. Yes, Father and Mother.

With a substantial rise of mothers paying child support in the United States, many women are reevaluating their situations, when they find out Dad will not be paying all expenses and child support and be prorated when raising the child 50% of the time. Today’s mothers are the primary breadwinners in four out of 10 U.S. families (Pew Research).

Texas statutes dictate specific Child Support guidelines and, like it or not, other than rare exceptions, neither parent can escape this obligation! Many mothers will plea that they cannot work because of their obligation to the care of the child or will under-employ to try to escape paying their rightful share of the child’s support. But in today’s world many parents either share 50/50 time with their child or father may be the primary custodial parent.

If the mother refuses to pay court-ordered child support, there may be several enforcement options. A contempt of court action can hold the mother civilly or criminally liable for not obeying the court’s mandate. If found guilty, the mother may be required to post a bond equal to the amount of child support in arrearages or may have to serve time in jail for contempt. Other actions include suspending the mother’s driver’s license or professional license, intercepting tax refunds or federal payments, denying passports, placing liens on property and reporting the debt to credit bureaus.

CHILD SUPPORT GUIDELINES BASED ON THE MONTHLY NET RESOURCES OF THE OBLIGOR:

- 1 child 20% of Obligor’s Net Resources

- 2 children 25% of Obligor’s Net Resources

- 3 children 30% of Obligor’s Net Resources

- 4 children 35% of Obligor’s Net Resources

- 5 children 40% of Obligor’s Net

- 6+ children Not less than the amount for 5 children

(3/5/2019 FAMILY CODE CHAPTER 154. CHILD SUPPORT https://statutes.capitol.texas.gov/Docs/FA/htm/FA.154.htm 20/47)

For more information on Texas Child Support Guidelines, please go to the Texas Attorney General Child Support Website at: https://csapps.oag.texas.gov/monthly-child-support-calculator

Mark Nacol

Nacol Law Firm

Dallas TX

Child Support Modification in Texas – Done Within Three Years

Child support is one of the most heavily litigated issues in all of family law. To increase or decrease payments there are specific requirements that must be met to modify a previous child support order. Per Tex. Fam. Code § 156.401 the requirements necessary to modify a prior child support order are:

- The circumstances of the child or an affected party have materially and substantially changed; or

- Three years have elapsed since the order was entered or last modified, and the amount of child support differs from the statutory guidelines by either 20% or $100.00.

The second requirement is self-explanatory. The three-year limitation to file for another modification is for the benefits of the Courts. If there was no three-year waiting period to refill, then every conservator would constantly attempt to modify child support, thus creating endless litigation for clogging the Courts’ dockets.

The first requirement needs more explanation. A Material and Substantial change in the circumstances of the child or an affected party must be clearly shown at trial. Many Courts are meticulous in making the determination of what a Material and Substantial change is regarding the child and the affected party to insure this requirement is not abused for excessive litigation.

To prove a Substantial and Material change in circumstances, a conservator must show evidence at the final hearing of:

- The financial needs/expenses at the time of the divorce or prior modification for the children and the person affected, and;

- The financial needs/expenses at the time of the request for the modification.

If evidence of financial needs/expenses are not submitted and proved regarding both (1) the prior divorce/modification and (2) the recent modification, then no Substantial and Material change can be adequately proved. Further, if the request for modification of child support is predicated solely on one conservator’s increase in earning capacity, absent other compelling evidence, the change in circumstances is not Substantial and Material. Interest of L.R., 416 S.W.3d 675, (Tex. App.—Houston [14 Dist.] 2013, pet. denied.)

If one conservator decides to file a modification of child support within three years just because the other conservative received a better job, it may be dismissed. At the end of the day a Court has broad discretion on determining what is Substantial and Material and may allow the case to be heard and give an unfavourable ruling, but if that occurs you will have the ability to appeal the judgment and request attorney’s fees. It is important to know in any family law case the Judge has extremely broad discretion and interprets case law in a way that he deems fit using the Best Interest Test.

If you are a conservator that meet these requirements above and wish to increase or decrease the child support obligation, be sure to hire an experienced attorney. Nacol Law Firm will always fight for you and your children’s best interest.

Julian Nacol, Attorney

Nacol Law Firm, PC

Call (972) 690-3333

Behind on Child Support ? Factors on Satisfying Texas Back Child Support Arrearage

In Texas it is the responsibility of a mother and father to adequately support their child. An adequate support usually comes in the form of child support payments monthly. It is a common mistake of judgment to attempt to hide from child support obligations or willfully ignore the obligation. Intentional non-payment gives rise to contempt proceedings

The circumstances regarding the parent’s decision not to pay child support is considered by the court in contempt proceedings. Texas Family Code 154.131 strictly deals with retroactive child support payments. There are four factors a Texas Court will consider when determining how far back a parent must make child support back-payments. They are:

- If the mother of the child had made any previous attempts to notify the obligor (delinquent parent) of his paternity or probable paternity;

- If the obligor (delinquent parent) had knowledge of his paternity or probable paternity;

- If the order of retroactive child support will impose an undue financial hardship on the obligor (delinquent parent) or the obligor’s family; and

- If the obligor (delinquent parent) has provided actual support or other necessities before the filing of the action.

All these factors will be taken into consideration by a Texas Court when determining how far back and how much an individual must pay child support.

If it is reasonable and in the best interest of the child then the Texas Family Code 154.131(c) allows for the Court to assign retroactive child support payments that only extends back 4 years. The option to confine retroactive child support payments to only four years may be contested by the parent requesting the child support. A parent that is contesting the Court’s decision in allowing the delinquent parent to pay back only four years’ worth of back-payments will have the burden of proof to establish:

- The Obligor (delinquent parent) knew or should have known that he was the father of the child for whom the support is sought

And

- The Obligor (delinquent parent) sought to avoid the establishment of support obligation to the child

If, however, a father is delinquent on child support because he did not know of the child’s existence, was told by the mother that his support was not wanted or needed, or the father had been paying a certain amount prior to the filling of the child support then the Court will likely only award retroactive payments of four years or less. If the father has willfully refused or ignored his obligation to pay support and adequately support his child, then the Court has the authority to order that delinquent parent to pay retroactive child support payments dating back to the day the child was born.

Retroactive child support can be complex and tricky considering the multiple circumstances in which this problem may arise. If you find yourself in this predicament and have received a summons to a Texas Child Support Court, then contact an experienced attorney immediately to see what can be done and how to best effetely address this unavoidable issue.

Delinquent Child Support in Texas = Denial of Motor Vehicle Registration Renewals

December 2016 the Texas Department of Motor Vehicles will start denying motor vehicle registration renewals for parents who have gone at least six months without making a child support payment. The law applies to Office of the Attorney General (OAG) child support cases.

The OAG also has the authority to bar the renewal of professional, recreational and handgun licensed of parents behind on child support payments.

Delinquent Parents will receive a notice from the Department of Motor Vehicles and a letter from the attorney general’s office about two months before their registration is set to expire.

Once parents receive a notice, they must agree to a payment plan with the Attorney General’s child support division before they will be able to renew their registration. This law only applies to motor vehicle renewals. New vehicle purchases are not affected.