Mediation : Alternative Dispute Resolution

“Mediation” is a process to aid parties in finding a fair and equitable settlement of disputes without unnecessary court intervention. Most Texas district and county courts require pretrial mediation for a variety of cases in order to help the parties resolve their problems while avoiding extensive court procedures and expenses

Mediation is a process in which the parties, under the guidance of a Mediator, agree upon a legally binding settlement the disputes in issue without a trial. Meditation can take many forms and the process may produce creative solutions without the direct rulings of the court. Courts usually encourage the opposing lawyers to first mediate a dispute and if no progress is made then continue the normal judicial process.

The Mediator that helps bring both sides to an agreement usually is a lawyer, ex-judge, or other specialist who has experience or expert training in the specific areas related to the dispute. A Mediator fees may range anywhere from $160-$500 dollars an hour depending on the case and the complexity of the issues in dispute. Mediators attempt to work with each side to find a reasonable middle ground to which a fair agreement can be structured.

An experienced lawyer is a valuable tool to advance favorable terms of any agreement during a mediation. During a mediation a Mediator will likely place the parties into separate “Caucus” areas, splitting the parties into different rooms to negotiate individually with each party to understand the positions and interests. Once the Mediator has talked to each party he will attempt to discover a common grounds that will fairly or smoothly serve both parties’ interests. If an agreement is reached that neither side is overly happy about, it is often likely that a reasonable compromise has been reached.

The important point of a mediation is to express your concerns and attempt to reach a compromise that is mutually acceptable, smart and fair to both sides. Many courts support this type of dispute resolution because it frees up the courts dockets and allow the parties to consider compromise first without involving the courts. Mediation maybe a cost saver, as the dollars you spend on an attorney for trial can be reduced significantly if a compromise is reached.

Make sure you have an attorney who is experienced in the Mediation process and knows how to craft a smart, fair deal which will result in significant cost savings.

New Texas Family Laws – Effective September 1, 2015

Now that the Texas Legislature has ended, we will review some of the bills passed that will affect our Family Law Cases.

S.B. 814 Waivers of Citations in Certain Family Law Suits

Currently, the state of Texas allows for a parties involved in a divorce to waive service. Loosely translated, that means that the person named in the divorce suit can sign a paper which proactively tells the relevant court that they are officially aware their spouse is filing for divorce. This waiver means they don’t have to physically be served with the divorce papers by their spouse or a process server, potentially saving everyone involved a bit of time, money, and maybe some emotional pain

S.B. 814 was introduced to further the use of such waivers to apply to other common family law matters.

The waiver should also be used for:

- Suits to remove disability of a minor (commonly referred to as emancipation)

- Suits to change the name of an adult or child

- Any suits relating to a parent-child relationship

The bill passed and will take effect on September 1, 2015.

S.B. 817: Issuance of a protective order and appointment of a managing conservator in certain family law proceedings.

S.B. 817 proposes that the state change the language on applications for protective orders (restraining orders, etc.) by switching the word “victim” with the phrase “applicant for a protective order.” Specifically, this change is meant to help those people who are applying for the protective order on behalf of the actual victim of the abuse or violence.

Some judges are currently reluctant to sign orders which list the applicant as a “victim” because doing so indirectly endorses the allegations of abuse as being true without a trial. With the label change, it removes that concern and will enable judges to issue more orders to protect those in need.

The bill passed virtually unopposed, and will take effect on September 1, 2015.

S.B. 314: Appointment of a non-parent as managing conservator of a child.

This law addresses a growing number of complaints by relatives who assume custody of children removed from their parents’ homes by CPS (Child Protective Services). This type of custody is called “permanent managing conservatorship,” or PMC. It is not adoption and does not carry the same legal meaning, but many relatives claim that these differences are not clarified by CPS.

As a result, the bill requires a court awarding custody to specifically explain 3 common misunderstandings to the relatives or non-parents assuming PMC.

- PMC rights are specified by the court, and are not the same as rights associated with adoption

- The parent(s) can still request visitation, and can request to become the managing conservator

- PMC does not qualify nor disqualify the relative or non-parent for/from post-adoption benefits

The bill states that if the non-parent assuming PMC does not appear in court, the court must then have evidence that they were advised of this information.

The bill passed without opposition, and will take effect on September 1, 2015.

Paternity in Texas – Is a Biological Father a Legal Father ?

A baby born to unwed parents does not have a legal father under Texas Law. In order to exercise your rights as a father, including visitation and possession, a man must be a child’s legal father. A common misconception is that if your name is on the birth certificate you are a legal father. If you are not married to the mother, simply putting your name on the birth certificate of your child is not enough to make you the “legal” father and you cannot enforce your rights to the child.

The process to become a legal father is a simple one. If the biological father and the mother agree, they can both sign an “Acknowledgement of Paternity” which is filed with the Bureau of Vital Statistics. Once paternity has been established, your name will be placed on the birth certificate, and the Court may order you to pay child support and grant you visitation or possession rights with your child.

TEXAS FAMILY LAW §160.301. ACKNOWLEDGEMENT OF PATERNITY

The mother of a child and a man claiming to be the biological father of the child may sign an acknowledgement of paternity with the intent to establish the man’s paternity.

TEXAS FAMILY LAW §160.302. EXECUTION OF ACKNOWLEDGEMENT OF PATERNITY

An acknowledgement of paternity must:

-

Be in a record;

-

Be signed, or otherwise authenticated, under penalty of perjury by the mother and the man seeking to establish paternity;

-

State that the child whose paternity is being acknowledged:

-

Does not have a presumed father or has a presumed father whose full name is stated;

-

Does not have another acknowledged or adjudicated father.

-

-

State whether there has been genetic testing and, if so, that the acknowledging man’s claim of paternity is consistent with the results of the testing;

-

State that the signatories understand that the acknowledgement is the equivalent of a judicial adjudication of the paternity of the child and that a challenge to the acknowledgement is permitted only under limited circumstances.

An acknowledgement of paternity is void if it:

-

States that another man is a presumed father of the child, unless a denial of paternity signed or otherwise authenticated by the presumed father is filed with the bureau of vital statistics;

-

States that another man is an acknowledged or adjudicated father of the child; or

-

Falsely denies the existence of a presumed, acknowledged, or adjudicated father of the child.

- A presumed father may sign or otherwise authenticate an acknowledgement of paternity.

Taxes 2014 : Who Is Entitled To Use The Tax Exemption on Children After a Divorce?

As we now approach the deadline for filing our 2014 federal income tax return, many divorced parents are asking this question, “Which parent may legally claim their children on their tax return”? This question has become complicated with the rise in fathers’ rights, expansion in non-custodial parents visitation periods, and advance parenting schedules allowing children to spend quality if not equal time with both parents throughout the year.

In the past the Internal Revenue Code provided that the custodial parent was allowed to claim the minor children on his/her federal income tax return. Mom was usually the custodial parent and Dad usually had the children every other weekend.

The Internal Revenue Code states that the parent with whom the child lived with for the greater number of nights during the year is entitled to claim the dependency exemption.

If during or following a divorce in final judgment, the two divorcing parents agree that one parent shall claim the child as a dependent in odd numbered years and the other parent in even numbered years, or if the divorcing parents have more than one child, one parent shall claim some children, while the other parent shall claim the other children, this agreement in your final divorce decree will be honored by the IRS.

If your divorce was final before 2008, just attach the final divorce decree to your tax return. If your divorce was final after 2008, your ex-spouse must fill out IRS form 8332 which provides the name of your children that you can claim on your federal income tax return.

I you are divorced in 2014 and have questions please contact your tax adviser or go to the website http://www.irs.gov/Forms-&-Pubs for more information.

Texas Child Support Guidelines Update

PLEASE READ UPDATE (2019)

Texas Child Support Guidelines Change-

Effective Sept. 1, 2019

Effective September 1, 2019 The Texas Child Support Division of the Attorney General increased the Maximum child Support under the Texas Child Support Guidelines from $8,550 to the “new cap”of net monthly resources to $9200 annually. This change in the law will increase the amount of maximum child support from of $1,710.00 to $1,840.00 monthly (20% of $9200. For one child)

CLICK TO READ MORE ON THIS UPDATE

PRIOR GUIDELINES

On September 1, 2013: Important Texas Child Support Guideline Changed!

The Texas Child Support Division of the Attorney General increased the “CAP” on net resources for purposed Child Support from the past amount of $7500 to be $8550, which became effective Sept. 1, 2013.

This “Cap Increase” affects any child support case filed or pending after September 1, 2013.

Under the Texas Family Code §154.125 the guidelines for Child Support are as follows:

(a) The guidelines for the support of a child in this section are specifically designed to apply to situations in which the obligor’s monthly net resources are not greater than $8,500 or the adjusted amount determined under Subsection (a-1), whichever is greater.

(a-1) The dollar amount prescribed by Subsection (a) above is adjusted every six years as necessary to reflect inflation. The Title IV-D agency shall compute the adjusted amount, to take effect beginning September 1 of the year of the adjustment, based on the percentage change in the consumer price index during the 72-month period preceding March 1 of the year of the adjustment, as rounded to the nearest $50 increment. The Title IV-D agency shall publish the adjusted amount in the Texas Register before September 1 of the year in which the adjustment takes effect. For purposes of this subsection, “consumer price index” has the meaning assigned by Section 341.201, Finance Code.

(a-2) The initial adjustment required by Subsection (a-1) shall take effect September 1, 2013. This subsection expires September 1, 2014.

(b) if the obligor’s monthly net resources are not greater than the amount provided by Subsection (a), the court shall presumptively apply the following schedule in rendering the child support order:

CHILD SUPPORT GUIDELINES

BASED ON THE MONTHLY NET RESOURCES OF THE OBLIGOR

- 1 child 20% of Obligor’s Net Resources

- 2 children 25% of Obligor’s Net Resources

- 3 children 30% of Obligor’s Net Resources

- 4 children 35% of Obligor’s Net Resources

- 5 children 40% of Obligor’s Net Resources

- 6+ children Not less than the amount for 5 children

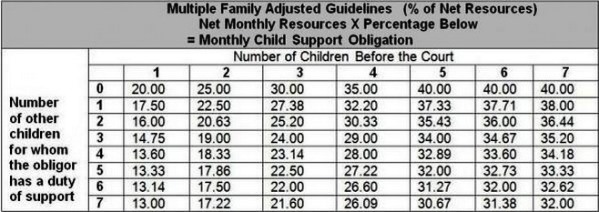

Depending on the number of other children an obligor has a duty to support, the percentage of child support may be lower. For example, if the obligor was previously married and has 1 child to support in the previous marriage, the amount of support paid for one child before the court decreases to 17.50 percent. See the chart below.

Net resources are determined by deducting the following from the obligor’s income:

1. Social Security Taxes;

2. Federal Income Tax based on the tax rate for a single person claiming one personal exemption and the standard deductions;

3. State Income Tax;

4. Union Dues (if such deductions are being withheld); and

5. Expenses for Health Insurance Coverage for Obligor’s Child(ren) (if such deductions are being withheld).