-

Fathers' Rights Dallas Attorneys

Never Give Up!

-

Fathers' Rights in Texas

NEVER GIVE UP!

Taxes 2014 : Who Is Entitled To Use The Tax Exemption on Children After a Divorce?

As we now approach the deadline for filing our 2014 federal income tax return, many divorced parents are asking this question, “Which parent may legally claim their children on their tax return”? This question has become complicated with the rise in fathers’ rights, expansion in non-custodial parents visitation periods, and advance parenting schedules allowing children to spend quality if not equal time with both parents throughout the year.

In the past the Internal Revenue Code provided that the custodial parent was allowed to claim the minor children on his/her federal income tax return. Mom was usually the custodial parent and Dad usually had the children every other weekend.

The Internal Revenue Code states that the parent with whom the child lived with for the greater number of nights during the year is entitled to claim the dependency exemption.

If during or following a divorce in final judgment, the two divorcing parents agree that one parent shall claim the child as a dependent in odd numbered years and the other parent in even numbered years, or if the divorcing parents have more than one child, one parent shall claim some children, while the other parent shall claim the other children, this agreement in your final divorce decree will be honored by the IRS.

If your divorce was final before 2008, just attach the final divorce decree to your tax return. If your divorce was final after 2008, your ex-spouse must fill out IRS form 8332 which provides the name of your children that you can claim on your federal income tax return.

I you are divorced in 2014 and have questions please contact your tax adviser or go to the website http://www.irs.gov/Forms-&-Pubs for more information.

Texas Child Support Guidelines Update

PLEASE READ UPDATE (2025)

Texas Child Support Guidelines Change-

Effective Sept. 1, 2025

Effective September 1, 2025 The Texas Child Support Division of the Attorney General increased the Maximum child Support under the Texas Child Support Guidelines from $9,200 to the “new cap”of net monthly resources to $11,700 annually.

CLICK to read more on the September 1, 2025 TEXAS CHILD SUPPORT UPDATE

PRIOR GUIDELINES

On September 1, 2013: Important Texas Child Support Guideline Changed!

The Texas Child Support Division of the Attorney General increased the “CAP” on net resources for purposed Child Support from the past amount of $7500 to be $8550, which became effective Sept. 1, 2013.

This “Cap Increase” affects any child support case filed or pending after September 1, 2013.

Under the Texas Family Code §154.125 the guidelines for Child Support are as follows:

(a) The guidelines for the support of a child in this section are specifically designed to apply to situations in which the obligor’s monthly net resources are not greater than $8,500 or the adjusted amount determined under Subsection (a-1), whichever is greater.

(a-1) The dollar amount prescribed by Subsection (a) above is adjusted every six years as necessary to reflect inflation. The Title IV-D agency shall compute the adjusted amount, to take effect beginning September 1 of the year of the adjustment, based on the percentage change in the consumer price index during the 72-month period preceding March 1 of the year of the adjustment, as rounded to the nearest $50 increment. The Title IV-D agency shall publish the adjusted amount in the Texas Register before September 1 of the year in which the adjustment takes effect. For purposes of this subsection, “consumer price index” has the meaning assigned by Section 341.201, Finance Code.

(a-2) The initial adjustment required by Subsection (a-1) shall take effect September 1, 2013. This subsection expires September 1, 2014.

(b) if the obligor’s monthly net resources are not greater than the amount provided by Subsection (a), the court shall presumptively apply the following schedule in rendering the child support order:

CHILD SUPPORT GUIDELINES

BASED ON THE MONTHLY NET RESOURCES OF THE OBLIGOR

- 1 child 20% of Obligor’s Net Resources

- 2 children 25% of Obligor’s Net Resources

- 3 children 30% of Obligor’s Net Resources

- 4 children 35% of Obligor’s Net Resources

- 5 children 40% of Obligor’s Net Resources

- 6+ children Not less than the amount for 5 children

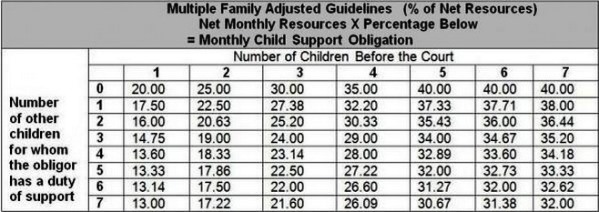

Depending on the number of other children an obligor has a duty to support, the percentage of child support may be lower. For example, if the obligor was previously married and has 1 child to support in the previous marriage, the amount of support paid for one child before the court decreases to 17.50 percent. See the chart below.

Net resources are determined by deducting the following from the obligor’s income:

1. Social Security Taxes;

2. Federal Income Tax based on the tax rate for a single person claiming one personal exemption and the standard deductions;

3. State Income Tax;

4. Union Dues (if such deductions are being withheld); and

5. Expenses for Health Insurance Coverage for Obligor’s Child(ren) (if such deductions are being withheld).

NACOL LAW FIRM P.C.

8144 Walnut Hill Lane

Suite 1190

Dallas, Texas 75231

972-690-3333

Office Hours

Monday – Thursday, 8am – 5pm

Friday, 8:30am – 5pm

OUR BLOGS

- About Dallas Attorney for Fathers Rights (3)

- Addictions and Divorce (2)

- Child Custody (20)

- Child Support For Fathers (10)

- Division of a Business (2)

- Divorce Checklist (9)

- Domestic Violence (8)

- Filing for a Divorce (9)

- Grandparents Rights in Texas (2)

- High Conflict Divorce (3)

- Impact on Children (7)

- Interstate Jurisdiction (9)

- Mediation (1)

- Modification Orders (2)

- Parent Alienation (15)

- Parental Rights (3)

- Paternity (16)

- Possession of Children (30)

- Prepare for Your Divorce (11)

- Property and Asset Division (25)

- Protective Orders (4)

- Social Networking (6)

- Special Needs Children and Divorce (2)

- Spousal Support (6)

- Stay At Home Dads (3)

- Tax Exemptions & Deductions (1)

- Texas Confidentiality Laws (1)

- Texas Prenuptial Agreements (3)

- UPDATE! New Texas Laws (9)

- Videos on Fathers Rights (14)

- Wills and Trusts (3)

- You Tube – Itunes for Fathers Rights Dallas (1)

SEARCH

JOIN OUR NETWORK

Attorney Mark A. Nacol is board certified in Civil Trial Law by the Texas Board of Legal Specialization