Child Custody across State Lines: Interstate Jurisdiction

During the Holiday season many Texas parents become very concerned over sending their child to the non-primary conservator parent’s home for a visit. Many Children will cross state lines to see their non-primary conservator parent and there is always a fear that the child may not be returned to his/her home state. What can you do if this does happen?

The State of Texas follows a uniform law regarding determination of appropriate state jurisdiction in custody matters known as the Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA), and related statutes which enforce or set procedures regarding proper jurisdiction such as the Parental Kidnapping Prevention Act. Texas has adopted these statutes. The Uniform Child Custody Jurisdiction Enforcement Act defines which state has or may maintain jurisdiction in a particular case and often mandates that other states recognize decisions handed down by the state determined to have jurisdiction.

The Act states, among other things, that a court may rule on custody issues if the Child:

• Has continually lived in a home state for 6 months or longer

• Was living in the state before being wrongfully taken elsewhere by a parent seeking custody in another state

• Has an established relationship with people (family, relatives or teachers), ties, and attachments in the state

• Has been abandoned: or is safe in current state, but could be in danger of neglect or abuse in the home state

How can Continuing Exclusive Jurisdiction be lost?

1. When A Texas Court determines that neither the child, or a child and one parent have a significant contact with Texas, and substantial evidence is no longer available in Texas concerning the child’s care, protection, and personal relationships

2. Texas or another state determines that the child and the child parents do not presently reside in Texas.

What about Jurisdiction to Modify an Existing Order?

In the absence of temporary emergency jurisdiction, Texas cannot modify a child custody decision made by another state’s court unless or until a court of this state has jurisdiction to make an initial custody determination and one of the following occurs:

1. Another State determines it no longer has continuing jurisdiction or finds that Texas would be a more convenient forum.

2. A court determines that the child and the child’s parents do not presently reside in the other state.

What about Temporary Emergency Jurisdiction?

Temporary emergency jurisdiction is reserved for very extraordinary circumstances. The court has and may assert jurisdiction only when a child is present in the state and has been abandoned or is in need of protection because of a threat or subjected the child to mistreatment or abuse.

When involved in an international child custody case where the child has been abducted or is wrongfully retained, the issue may be determined if the International Child Abduction Remedies Act, 12 USC Section 11.601-11610, of the Hague Convention, is applicable. If so, The US State Department Office of Citizen & Counselor Services should be contacted or any attorney may file suit for return of the child.

These interstate jurisdiction cases are very intensive. Get to a knowledgeable attorney and assert your rights quickly. Protect you and your child’s rights to have a normal child/parent relationship without the fear of abduction!

Fathers Financial Check List in Preparation for a Texas Divorce

Preparing for a Texas Divorce: Assets

Preparing for a divorce is painful no matter the circumstance. Before you get into the tangle of the Texas divorce process, you can reduce the expense, stress and conflict many people face by making sure you are prepared. Planning ahead allows you to make sound decisions and start preparing for your life post-divorce, and may also help you avoid post-divorce pitfalls. Below is a list of items you need to gather before counseling with an attorney.

Documents

1. A Listing of all Real Property, address and location, including (include time-shares and vacation properties):

1. Deeds of Trust

2. Notes

3. Legal Description

4. Mortgage Companies (Name, Address, Telephone Number, Account Number, Balance of Note, Monthly Payments)

5. Current fair market value

2. Cash and accounts with financial institutions (checking, savings, commercial bank accounts, credit union funds, IRA’s, CD’s, 401K’s, pension plans and any other form of retirement accounts):

1. Name of institution, address and telephone number

2. Amount in institution on date of marriage

3. Amount in institution currently

4. Account Number

5. Names on Account

3. Retirement Benefits

1. Exact name of plan

2. Address of plan administrator

3. Employer

4. Employee

5. Starting date of contributions

6. Amount in account on date of marriage

7. Amount currently in account

8. Balance of any loan against plan

4. Publicly traded stock, bonds and other securities (include securities not in a brokerage, mutual fund, or retirement account):

1. Number of shares

2. Type of securities

3. Certificate numbers

4. In possession of

5. Name of exchange which listed

6. Pledged as collateral?

7. Date acquired

8. Tax basis

9. Current market value

10. If stock (date option granted, number of shares and value per share)

5. Insurance and Annuities

1. Name of insurance company

2. Policy Number

3. Insured

4. Type of insurance (whole/term/universal)

5. Amount of monthly premiums

6. Date of Issue

7. Face amount

8. Cash surrender value

9. Current surrender value

10. Designated beneficiary

6. Closely held business interests:

1. Name of business

2. Address

3. Type of business

4. % of ownership

5. Number of shares owned if applicable

6. Value of shares

7. Balance of accounts receivables

8. Cash flow reports

9. Balance of liabilities

10. List of company assets

7. Mineral Interests (include any property in which you own the mineral estate, separate and apart from the surface estate, such as oil and gas leases; also include royalty interests, work interests, and producing and non-producing oil and gas wells.

1. Name of mineral interest

2. Type of interest

3. County of location

4. Legal description

5. Name of producer/operator

6. Current market value

8. Motor Vehicles (including mobile homes, boats, trailers, motorcycles, recreational vehicles; exclude company owned)

1. Year

2. Make

3. Model

4. Value

5. Name on title

6. VIN Number

7. Fair Market Value

8. Name of creditor (if any), address and telephone

9. Persons listed on debt

10. Account number

11. Balance of any loan and monthly payment

12. Net Equity in vehicle

9. Money owed by spouse (including any expected federal or state income tax refund but not including receivables connected with any business)

10. Household furniture, furnishings and Fixtures

11. Electronics and computers

12. Antiques, artwork and collectibles (including works of art, paintings, tapestry, rugs, crystal, coin or stamp collections)

13. Miscellaneous sporting goods and firearms

14. Jewelry

15. Animals and livestock

16. Farming equipment

17. Club Memberships

18. Travel Award Benefits (including frequent flyer miles)

19. Safe deposit box items

20. Burial plots

21. Items in any storage facility

22. A listing of separate property (property prior to marriage, family heir looms, property gifted)

23. Listing of all liabilities (including mortgages, credit card debt, personal loans, automobile loans, etc.):

a. Name of entity, address and telephone number

b. Account number

c. Amount owed

d. Monthly payment

e. Property securing payment (if any)

f. Persons listed as liable for debt

Ho! Ho! Ho! Texas Children’s Visitation Schedules and the Holidays

The Holiday season is now upon us and hopefully all parents have worked out the upcoming visitation schedules for the 2012 Holiday Season. But if not you need to be working on it now! Here is a reminder of the current Texas Family Law

Code’s Standard Possession Order for Holidays.

§ 153.314. Holiday Possession Unaffected by Distance Parents Reside Apart.

The following provisions govern possession of the child for certain specific holidays and supersede conflicting weekend or Thursday periods of possession without regard to the distance the parents reside apart. The possessory conservator and the managing conservator shall have rights of possession of the child as follows:

Texas Family Law Code’s Standard Visitation Guidelines for Christmas Break:

(1) the possessory conservator shall have possession of the child in even-numbered years beginning at 6 p.m. on the day the child is dismissed from school for the Christmas school vacation and ending at noon on December 28, and the managing conservator shall have possession for the same period in odd-numbered years;

(2) the possessory conservator shall have possession of the child in odd-numbered years beginning at noon on December 28 and ending at 6 p.m. on the day before school resumes after that vacation, and the managing conservator shall have possession for the same period in even-numbered years;

Texas Family Law Code’s Standard Visitation Guidelines for Thanksgiving:

(3) the possessory conservator shall have possession of the child in odd-numbered years, beginning at 6 p.m. on the day the child is dismissed from school before Thanksgiving and ending at 6 p.m. on the following Sunday, and the managing conservator shall have possession for the same period in even-numbered years;

Texas Family Law Code’s Standard Visitation Guidelines for Child’s Birthday:

(4) the parent not otherwise entitled under this standard order to present possession of a child on the child’s birthday shall have possession of the child beginning at 6 p.m. and ending at 8 p.m. on that day, provided that the parent picks up the child from the residence of the conservator entitled to possession and returns the child to that same place;

Texas Family Law Code’s Standard Visitation Guidelines for Father’s Day:

(5) if a conservator, the father shall have possession of the child beginning at 6 p.m. on the Friday preceding Father’s Day and ending on Father’s Day at 6 p.m., provided that, if he is not otherwise entitled under this standard order to present possession of the child, he picks up the child from the residence of the conservator entitled to possession and returns the child to that same place;

Texas Family Law Code’s Standard Visitation Guidelines for Mother’s Day:

(6) if a conservator, the mother shall have possession of the child beginning at 6 p.m. on the Friday preceding Mother’s Day and ending on Mother’s Day at 6 p.m., provided that, if she is not otherwise entitled under this standard order to present possession of the child, she picks up the child from the residence of the conservator entitled to possession and returns the child to that same place.

Texas child visitation orders may differ from the norm to accommodate family situations so you should always check your decree first! If in doubt about your holiday visitation time, contact an attorney who can help you to make sure nothing happens to affect this special season with your children. ‘Tis the Season To Be Jolly’!

Dallas Fathers Rights Attorneys

Are you needing a Dallas fathers rights attorney? Attorneys Mark Nacol and Julian Nacol, with the Nacol Law Firm P.C., provide legal counsel and representation to help you protect your rights as a father.

Are you a father or husband involved with pending divorce, paternity, modifications, property and asset division, child custody, child support or visitation issues? Perhaps you have issues involving parental alienation, false allegations of abuse or false paternity claims.

It is important for you to know your legal rights as a father!

Call our Dallas fathers rights attorneys, Mark Nacol and Julian Nacol, for a consultation today.

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite 1190

Dallas, Texas 75231

Metro: 972-690-3333

Toll Free: 866-352-5240

Texas Divorce Spousal Maintenance Calculator

Texas is one of the most restrictive states when it comes to ordering spousal support; or “maintenance” as it is defined in the Texas statute. Texas House Bill 901 changing the spousal maintenance law in the Texas Family Code became effective for divorce cases on September 1, 2011. The bill revised the conditions that establish eligibility for spousal maintenance, commonly referred to as alimony and changed the factors required to be considered by a court in determining the nature, amount, duration, and manner of periodic payments for a spouse who is eligible to receive maintenance.

The court that determines a spouse is eligible to receive maintenance shall determine the nature, amount, duration, and manner of periodic payments by considering all relevant factors, including:

(1) each spouse’s ability to provide for that spouse’s minimum reasonable needs independently, considering that spouse’s financial resources on dissolution of the marriage;

(2) the education and employment skills of the spouses, the time necessary to acquire sufficient education or training to enable the spouse seeking maintenance to earn sufficient income, and the availability and feasibility of that education or training;

(3) the duration of the marriage;

(4) the age, employment history, earning ability, and physical and emotional condition of the spouse seeking maintenance;

(5) the effect on each spouse’s ability to provide for that spouse’s minimum reasonable needs while providing periodic child support payments or maintenance, if applicable;

(6) acts by either spouse resulting in excessive or abnormal expenditures or destruction, concealment, or fraudulent disposition of community property, joint tenancy, or other property held in common;

(7) the contribution by one spouse to the education, training, or increased earning power of the other spouse;

(8) the property brought to the marriage by either spouse;

(9) the contribution of a spouse as homemaker;

(10) Marital misconduct, including adultery and cruel treatment, by either spouse during the marriage; and

(11) Any history or pattern of family violence, as defined by Section 71.004 of the Texas Family Code.

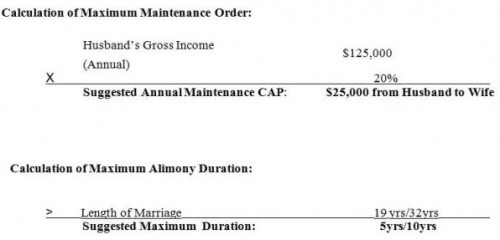

The maximum amount of spousal support that courts may award is the lesser of $5,000.00 per month or 20 percent of the payer’s average gross monthly income. This is the maximum amount of maintenance the court orders.

However, in all circumstances, the law provides that the Court shall order maintenance for the shortest reasonable period that allows the recipient to earn sufficient income to meet his or her “minimum reasonable needs” and as follows:

The Texas law mandates the maximum duration of support as follows:

Maintenance shall be paid for a maximum of:

• 5 years, if due to family violence conviction and marriage is under 10 years;

• 5 years, if marriage is between 10 and 20 years;

• 7 years, if marriage is between 20 and 30 years;

• 10 years, if marriage is 30 years or more;

except in the case of an incapacitating physical or mental disability, in which case the award may last as long as the disability.

In addition, the law allows the Texas Family Law Courts to terminate maintenance if the recipient “cohabits with another person in a permanent place of abode on a continuing, conjugal basis.”

Sample Calculation of Texas Spousal Support Maintenance: