What to Do if you are Served with a Divorce Petition, Citation, or Notice to Appear

A divorce proceeding is a difficult time for all parties involved. It is scary to be “served” with a petition for divorce. Fear, anxiety, and confusion are just some of the emotions that go through one’s mind when reading and absorbing an official Court document stating that a spouse wishes to end the relationship. Here are a few tips to keep in mind when you are served.

First, it is not the total end of the world. Do not give into immediate impulses and passions or fall prey to threatening or aggressive messages. Remember anything you say or do, especially in messages, texts or emails, may be used against you at Court. Do not give your spouse free arguments for the divorce.

Second, DO NOT use social media to vent frustration or talk about the divorce. Anything you write to third parties on social media may and will be used against you in Court. It may be hard but for your own benefit do not engage in frustrated tirades regarding your spouse on Facebook.

Third, find an experienced attorney, especially if children are involved. Be smart. It is not always prudent to hire a lawyer based on what appears to be the best financial deal possible when your children and possessions are at stake. The old axiom “you get what you pay for” is true when it comes to legal representation.

Fourth, be wary of Pro Se representation. Pro Se means that you have chosen to represent yourself in the divorce case. This may end very badly for you. Many people believe that if they research enough and familiarize themselves with the Texas Family Law Code they just might be able to receive a good outcome and drive up the attorney cost for the other spouse. Attorneys go to school for many years for a reason. The outcomes for Pro Se clients are not usually good and do not be tricked into taking on an inexperienced attorney to save money.

Fifth, save all hateful and scandalous remarks made by your spouse that have been emailed, texted, posted on social media or any other proof that can be saved against your spouse. Delete Nothing! Allow your spouse to dig his/her own hole. All of both spouse’s comments may be used in Court.

Finally, do not listen to your Spouse about any type of perceived legal outcomes. “I talked to a divorce lawyer and he said you better sign this or I will get everything…”. This is common in family law. Do not fall for the trap, seek experienced representation and let the divorce lawyer deal with your spouse or your spouse’s attorney. Do not be tricked into settling or giving up your children or possessions without competent assistance and advice from legal counsel.

Follow this advice and it will greatly help your probabilities with obtaining a favorable and fair outcome in your divorce case.

Nacol Law Firm P.C.

Dallas Divorce Attorneys

(972) 690-3333

Texas Divorce: What Happens During the Divorce Process?

Divorce is frustrating, confusing, and personally resentful. Divorce is never a pleasant experience even in the most amicable terms. It is important to know what you are in for when a divorce is filed. An original petition will be filed by one of the spouses (the petitioner). Then, the Respondent spouse must be served with papers by a process server unless they will agree to waiver service.

After service of the original petition, the Petitioner may file for a Temporary Restraining Order (“TRO”) to protect the child and marital estate. Once a TRO is granted by the District Judge, a temporary order hearing will be set within 14 days. This temporary order hearing is extremely important and will determine the direction of the case.

Temporary Order hearings are usually condensed to 20 minutes a side depending on the complexities of the case. Within these 20 minutes, you will have to put on evidence for your entire case regarding custody of the children, management of the marital estate, and any other considerations such as receivership of a business.

After the temporary orders hearing, the case will dive into full throttle litigation. Discovery on both sides is usually conducted including interrogatories, admissions, and production of documentation. The documents that are usually requested consists of bank statements, retirement pensions, social media pages, text messages, and emails. Each case requires specific Discovery requests that are narrowly tailored to the facts presented. Discovery can last months and usually follow with motions to compel and sanctions. In highly contested cases the rigors of discovery and compiling documentation can be brutal.

During the Discovery phase, Depositions may be warranted. Depositions consists of your attorney questioning your spouse and any other witnesses that are relevant to the case for impeachment purposes. Depositions are necessary if the case will go to a jury, because impeachment of your spouse is a necessity to prove your truthfulness.

Mediation is often mandatory in Courts, but this is the general rule. Certain Courts in the Dallas, Fort Worth, and Collin county do not require mandatory mediation. Each Court has its own rules of procedure and requirements. If the Mediation fails to produce a settlement between you and your spouse, then the only thing left is a trial.

Depending on the complexities of the case and assets, a trial can last half a day or be a three-day trial. Most trials are before the District Judge. Certain facts may give rise to a jury trial, but a jury trial is more costly and can take up more time. After the trial is complete the parties will have to wait for a ruling. This can take days to months depending on the case and jurisdiction.

When the final ruling is given to all parties, the Judge will charge one party to create a final order that will be submitted to the Court. This can give rise to more litigation depending on the interpretation of the Judge’s rulings by both parties. Finally, when both parties agree to a final order or the Judge determines which version of the final order is proper, then the case will be over.

Divorce can be a painful process that lasts 6 months to three years depending on the circumstances and the nature of the parties involved. If you are about to file for a Divorce in the DFW Metroplex or need help call the Nacol Law Firm, experienced family law attorneys to represent your best interests throughout this painful process.

Nacol Law Firm P.C.

Julian Nacol, Attorney

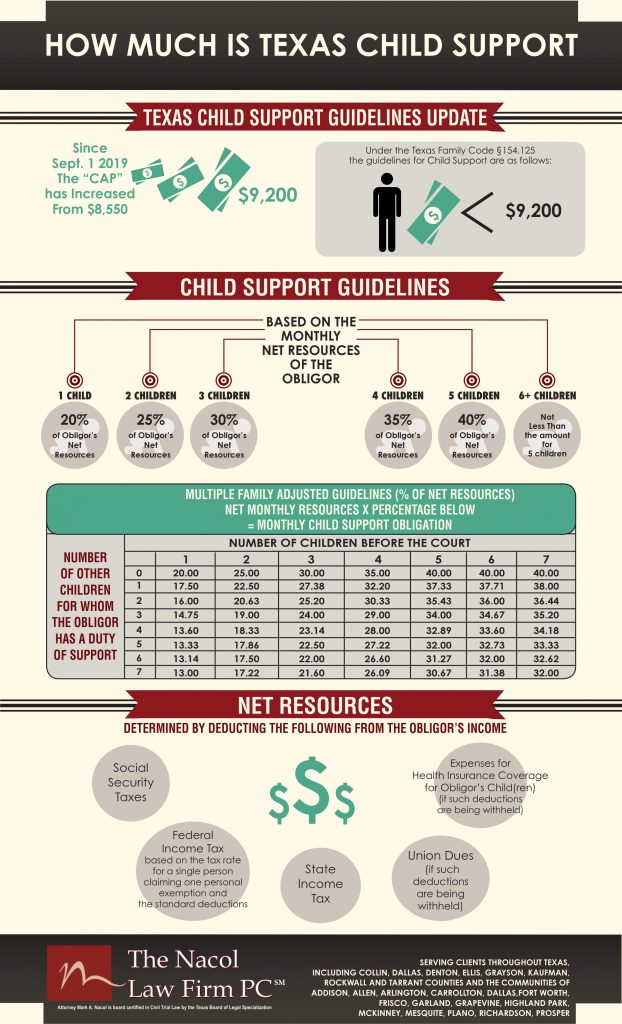

How Much is Texas Child Support? Texas Child Support Guidelines

Effective September 1, 2019 The Texas Child Support Division of the Attorney General increased the Maximum child Support under the Texas Child Support Guidelines from $8,550 to the “new cap”of net monthly resources to $9200 annually. This change in the law will increase the amount of maximum child support from of $1,710.00 to $1,840.00 monthly (20% of $9200. For one child)

Texas Family Code §154.125(a)(1) requires that every six years the presumptive amount of net resources to which the child support guidelines apply shall be reviewed and adjusted for inflation by the Texas Office of the Texas Attorney General (OAG). That section sets out the formula for doing so based on the consumer price index. The last adjustment was done in 2013 when the current amount of $8550 per month was established.

How does the “cap” work and what could this mean for you? If your net monthly resources are less than $8,550, the child support obligation will not change on Sept. 1. You are under the “current cap” and lower than the “new cap”. All stays the same.

If you are currently going through litigation and your net monthly resources exceeds $8,550 and the Court orders child support prior to September 1, 2019, Texas Child Support Guidelines will mandate that the Court apply the appropriate child support percentage to the first $8,550 in net monthly resources based on the number of children. But, if the Court orders child support after September 1, 2019, it will apply the new appropriate child support percentage to the first $9,200 in net monthly resources.

Child support under the guidelines is determined by applying the applicable percentage, beginning at 20% for one child and increasing incrementally for each additional child, to the net resources amount. If a child support obligor has monthly net resources over $9200, a party seeking above the guideline’s child support has the burden of proving to the court that additional support should be ordered according to factors set out in Texas Family Code §154.126.

Important to Know: The new “cap” increase of September 1, 2019 will not automatically increase the obligor’s existing child support obligation. Any change in child support standing before September 1, 2019, can only occur through the court with a modification order to increase the child support to the new “Cap” amount of $9200. After September 1, 2019, any new suit for child support will be subject to the new “cap”.

Please review the Texas Office of the Texas Attorney General (OAG) website for a child support calculator for the new breakdown: https://csapps.oag.texas.gov/monthly-child-support-calculator

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite #1190

Dallas, Texas 75231

Nacollawfirm.com

Your 2023 Texas Holiday Visitation Schedule with your Children

Now is the time to review your 2032 Holiday Visitation Schedule with your children.

Here is a reminder of the current Texas Family Law Code’s Standard Possession Order for the 2023 Holidays.

Texas 2023 Family Law Code’s Standard Visitation Guidelines for Thanksgiving:

The possessory conservator or non-primary conservator shall have possession of the child in odd-numbered years, beginning at 6 p.m. on the day the child is dismissed from school before Thanksgiving and ending at 6 p.m. on the following Sunday, and the managing conservator shall have possession for the same period in even-numbered years; The Holiday schedule will always override the Thursday or Weekend schedules.

Texas Family Law Code’s Standard Visitation Guidelines for Christmas Break:

The possessory conservator or non-primary conservator shall have possession of the child in even numbered years beginning at 6 p.m. on the day the child is dismissed from school for the Christmas school vacation and ending at noon on December 28, and the managing conservator shall have possession for the same period in odd-numbered years.

The possessory conservator or non-primary conservator shall have possession of the child in even-numbered years beginning at noon on December 28 and ending at 6 p.m. on the day before school resumes after that vacation, and the managing conservator shall have possession for the same period in odd-numbered years; The Holiday schedule will always override the Thursday or Weekend schedules.

The Holiday Season should be a happy family time. Many times, emotional issues from the result of the break-up affects a family which causes the joy of the season to be overshadowed by unhappiness and despair! Children need to have structure in their Holiday Visitation Schedule to ensure that they will be able to see both parents and share the joy of the season with their entire family. The children are often the ones who suffer when the Holiday Visitation arrangement goes awry.

Unfortunately, many parents may wait too long to confirm visitation plans for this upcoming holiday season. If you cannot reach an agreement regarding visitation or believe you may be deprived of holiday visitation by the other parent, now is the time to contact an attorney. Time is short and Courts are already starting to overload with future visitation problems for the 2023 Holiday Season.

The best gift a child can experience for the Holiday Season is an early proactive arrangement of all holiday plans between both parents. Everyone needs to know dates and times for visitation with both Mom and Dad. This Holiday Season vow to keep your child out of the middle of any family conflict and start to develop new holiday traditions with your child and family. Many parents have new relationships/marriages and other children in the family group. The new holiday traditions should include everyone and be a bonding experience for years to come.

Call Us. We Can Help!

Nacol Law Firm P.C.

Dallas Fathers Rights Attorneys

(972) 690-3333

Temporary Restraining Orders in Texas – What Does a TRO Do

A temporary restraining order, commonly known as a “TRO” is used in family law to place injunctions without a full hearing on one or both parties. These injunctions prohibit specific actions that could endanger or prove damaging to the property in a divorce or the children of a divorce. You should have an idea on what the process entails.

A TRO is governed by Texas Rules of Civil Procedure Rule 680 and Texas Family Code § 6.501. If your spouse wishes to file a TRO that immediately excludes you from possession of or access to your children, a notice of this hearing must be given to you prior to the court date. The only exception to this is an Ex-Parte meeting with the judge, which means that only your spouse or her attorney will be present at the preliminary hearing. The judge may order a TRO Ex-Parte only if the TRO clearly demonstrates from specific facts shown by affidavit or by a verified complaint that immediate and irreparable injury, loss, or damage will result to the applicant or children before notice can be served and an actual hearing.

If you are on the receiving end of TRO and it prohibits you from access to your children, there are some things to keep in mind.

First: a TRO has a time limit, which is 14 days. After 14 days the TRO may be extended by a judge only once for an additional 14 days. Thus at most this TRO may only last 28 days’ absent agreement to an additional extension. A Judge does have the discretion to extend the TRO more than once if it is uncontested (you do nothing or do not appear).

Second: A TRO is NOT a Protective Order. This means that the police cannot kick you out of your house or forcibly arrest you for violating a TRO, absent any related criminal conduct. There are consequences for violating the TRO but not criminal consequence. You may be found in contempt of court by the Judge who ordered the TRO and forced to pay fines or be held to more severe sanctions. Violations will not be good for your case if you intentionally violate.

Third: A TRO must have a signed and notarized Affidavit or a verified pleading attached to the motion. If the opposing counsel did not follow these procedures the order may upon motion to dissolve be found void due to violation of the Texas Rules of Civil Procedure.

Fourth: You cannot practically appeal a TRO because it may only last for at most 28 days, if contested. Once you are served with the Ex-Parte TRO, you may request a motion to modify or dissolve the TRO after giving your spouse 48-hour notice and seek attorney fees if the filing was false or frivolous.

TRO’s are civil injunctions that are usually given without notice only if immediate and irreparable injury, loss, or damage will happen. The proof rules are more relaxed in Family Law Cases. Specific TRO procedures can differ in all counties and in different courts so make sure the check online the rules of each specific jurisdiction.

TRO’s only last 14 days and cannot be enforced by police officers, absent related criminal activity. Do not be distressed if you are served a TRO one day while you are battling your spouse for child custody or property. Take a deep breath call your attorney and set a hearing to modify, vacate or dissolve the TRO.

Many counties have standing orders that issue and are effective as to both parties upon the filing of a Family Law Proceeding. Read such mandatory orders before you file your case.